Navigating the Financial Planning Landscape

Understanding financial planning tools requires familiarity with the various options available and their specific advantages. From budgeting apps to investment platforms, the landscape is diverse. Start by identifying your financial goals, whether they’re saving for retirement, buying a home, or managing debt. Each tool serves different purposes, enabling you to tailor your approach and enhance your financial strategy. Take time to explore each tool’s features, as some may offer integrated services, allowing seamless tracking of multiple financial aspects.

The Importance of Financial Literacy

Financial literacy empowers you to make informed decisions about your finances. By grasping necessary concepts such as interest rates, budgeting, and investment returns, you significantly enhance your ability to build wealth. Understanding these elements can save you from costly mistakes and help you seize opportunities that align with your goals.

Key Principles of Effective Financial Planning

Effective financial planning revolves around several key principles that guide you toward achieving your financial objectives. Start with setting clear, measurable goals, then create a realistic budget that reflects your income and expenses. Regularly reviewing and adjusting your financial plan helps ensure you’re on the right track, adapting to any changes in your financial situation or life circumstances. Maintaining an emergency fund is also vital, providing a safety net for unexpected expenses while keeping you from derailing your long-term plans.

Consider the 50/30/20 rule, which suggests allocating 50% of your income to needs, 30% to wants, and 20% for savings or debt repayment. This straightforward approach simplifies budgeting and ensures that you aren’t just surviving but also thriving financially. Consistently tracking your expenses can surface insights about spending habits, revealing areas where you can cut back or invest more effectively. Also, prioritize debt repayment, starting with high-interest debts to free up cash flow for savings and investments. By integrating these principles into your financial strategy, you position yourself for long-term stability and growth.

Key Takeaways:

- Understand your financial goals: Clearly define your short-term and long-term financial objectives to choose the right planning tools.

- Explore budgeting options: Utilize different budgeting tools to track income and expenses, helping to maintain financial discipline.

- Assess investment strategies: Research various investment options and their corresponding tools to effectively grow your wealth over time.

- Incorporate retirement planning: Use retirement calculators to estimate required savings and develop a plan that aligns with your future lifestyle.

- Review and adjust regularly: Continually evaluate your financial plans and tools to ensure they adapt to changes in your financial situation or goals.

Analyzing Your Financial Health

Taking a close look at your financial health enables you to identify strengths and weaknesses within your finances. This process involves reviewing your income, expenses, savings, and investments to measure where you currently stand. By actively engaging with these figures, you can craft a roadmap that aligns your financial behavior with your goals, ensuring you’ve got the right tools and knowledge to move forward effectively.

Tools for Comprehensive Budgeting

Budgeting tools like Mint, YNAB (You Need A Budget), and Personal Capital excel in helping you track your income and expenses. These platforms allow you to categorize spending, set limits, and visualize your cash flow, making it easier to spot trends and areas for improvement. By utilizing these tools, you can establish a comprehensive budgeting system that keeps you accountable and encourages better financial decision-making.

Assessing Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) serves as a vital indicator of your overall financial health, showing how much of your income goes towards servicing debt. Ideally, a DTI below 36% is recommended, with no more than 28% of your gross income allocated to housing costs. To calculate it, simply divide your total monthly debt payments by your gross monthly income. For instance, if you earn $5,000 a month and have $1,500 in monthly debt payments, your DTI would be 30%, indicating manageable debt levels and improving your chances of credit approval.

Monitoring your DTI helps you identify when debt levels become concerning. Adjusting your spending habits, prioritizing debt repayment, and possibly consolidating loans can assist in achieving a healthier balance. Regularly assessing this ratio allows you to make informed financial choices and adjust your budget as needed to maintain or improve your standing in prospective lender evaluations.

Essential Tools for Goal Setting and Tracking

Setting and tracking financial goals requires the right tools to keep you organized and focused. Utilizing innovative software and apps will enable you to visualize your progress, adjust your strategy, and stay motivated along your financial journey. These important tools help you break down your big-picture aspirations into actionable steps, ensuring you’re always moving toward your objectives.

Smartphone Apps and Digital Solutions

Smartphone apps have revolutionized the way you manage and track your financial goals. Services like YNAB (You Need A Budget), Mint, and PocketGuard allow you to monitor your expenses, save, and set specific goals all from the convenience of your pocket. These platforms often come with intuitive interfaces and charting tools, helping you visualize progress and spot areas for improvement effortlessly.

Setting SMART Financial Goals

Crafting SMART financial goals is important for achieving clarity and direction in your financial planning. The SMART framework stands for Specific, Measurable, Achievable, Relevant, and Time-bound, ensuring your goals are well-defined and actionable. For instance, instead of saying, “I want to save money,” you might express, “I will save $5,000 for a down payment on my house in the next 12 months.” This specificity provides a clear target and timeline, making it easier to track your progress and maintain motivation.

Unpacking Investment Strategies for Beginners

Diving into investment strategies can be daunting, but starting with the basics can set you on the right path. Understanding different types of investments, such as stocks, bonds, and mutual funds, allows you to create a diversified portfolio. You’ll want to research opportunities that align with your financial goals and risk tolerance. Over time, you can adjust your strategy as you gain experience and confidence in managing your investments.

Accessing User-Friendly Investment Platforms

User-friendly investment platforms have revolutionized the way beginners approach investing. Platforms like Robinhood, Acorns, and Fidelity offer straightforward interfaces that make trade execution easier and more transparent. Many provide educational resources, allowing you to enhance your understanding of diverse investment options and strategies. With intuitive tools for tracking performance and a range of asset classes to explore, you can start building your portfolio in no time.

Understanding Risk Tolerance and Asset Allocation

Getting a grasp on your risk tolerance and implementing effective asset allocation is foundational to successful investing. Your risk tolerance reflects your ability to endure fluctuations in investment value, influenced by factors like time horizon and emotional resilience. Asset allocation involves dividing your investments among different categories, such as stocks, bonds, and cash, tailored to your unique risk profile and goals. This balance helps optimize returns while minimizing risk.

To gauge your risk tolerance accurately, consider using assessments provided by investment platforms. A common approach is classifying risk tolerance into categories—conservative, moderate, and aggressive. For example, conservative investors might maintain 40% stocks and 60% bonds, seeking lower returns but stability. Conversely, aggressive investors may opt for an 80% stock allocation for higher long-term growth potential. By regularly reviewing and adjusting your asset allocation in response to market conditions and life changes, you ensure your portfolio remains aligned with your financial objectives.

Automating Your Financial Journey

Embracing automation can transform your financial planning strategy, allowing you to focus on long-term goals without getting bogged down by day-to-day management. Setting up automatic transactions means your savings, investments, and payments are processed seamlessly, reducing human error and the stress of manual tracking. With a few simple setups, you can create a path toward financial security and efficiency.

Benefits of Setting Up Automatic Savings

Establishing automatic savings provides numerous advantages, including the elimination of temptation to spend your income. By transferring a set amount into your savings account each month, you cultivate a consistent habit of saving. This process leads to easier budget management and eliminates concern about forgetting to save, ultimately accelerating your journey toward financial milestones.

Utilizing Robo-Advisors for Portfolio Management

Robo-advisors offer a smart solution for hands-off investing, using algorithms to manage your portfolio based on your risk tolerance and financial goals. These platforms typically charge lower fees than traditional advisors, making them accessible for beginners. Furthermore, robo-advisors provide diversification strategies and automatic rebalancing, ensuring your investments remain aligned with your objectives.

Many popular robo-advisors, such as Betterment and Wealthfront, use advanced algorithms to tailor investment portfolios according to individual preferences. For instance, if you’re a conservative investor, the system will adjust allocations towards safer assets like bonds. As your investment grows, rebalancing occurs automatically to maintain your desired risk level. Additionally, these platforms often include tax-loss harvesting features, potentially increasing your after-tax returns. By choosing to rely on robo-advisors, you position yourself to leverage technology for efficient financial governance with minimal ongoing effort.

Transforming Financial Insights into Actionable Steps

Translating financial insights into actionable steps is vital for effective planning. You can take your newfound knowledge about budgeting, investment opportunities, and savings strategies and create a roadmap for your financial future. By breaking down insights into manageable tasks, such as setting savings goals or creating a debt repayment plan, you empower yourself to make tangible progress. Regular review and adjustment of this plan ensures that you stay on track with your evolving financial circumstances.

The Role of Financial Education Resources

Accessing quality financial education resources equips you with the knowledge necessary to navigate fiscal challenges. Books, online courses, and webinars provide valuable information on investing, saving, and budgeting. These resources can bridge the gap between perception and reality, helping you understand complex concepts and make informed decisions. Committing to continual learning reinforces your confidence in managing personal finances effectively.

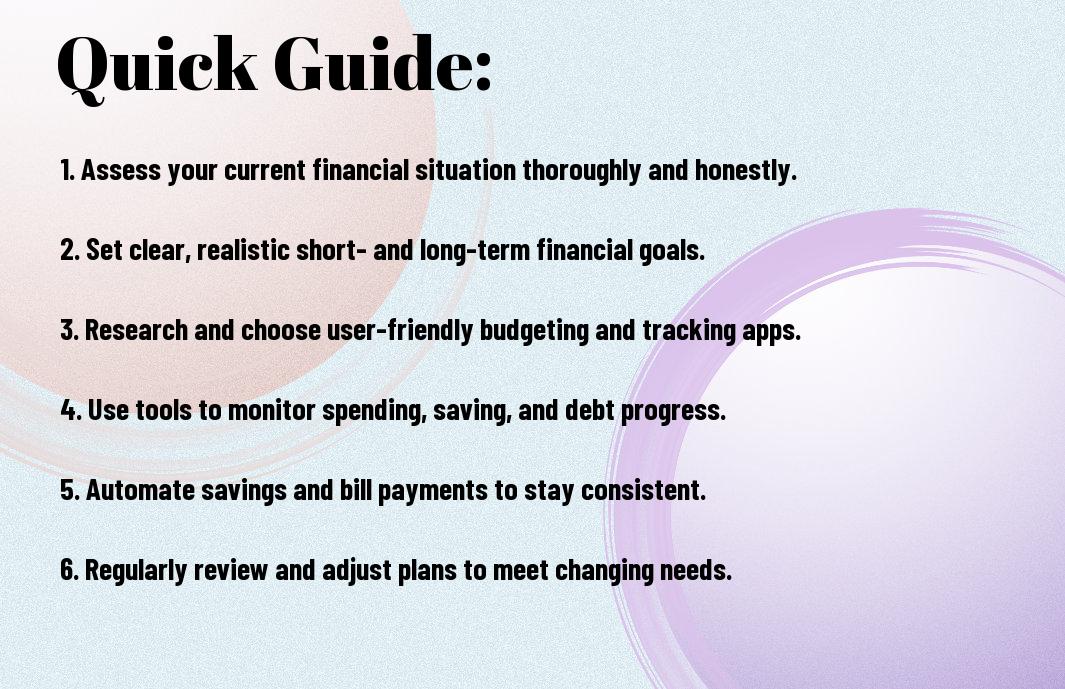

Building Your Personal Finance Action Plan

Creating a personal finance action plan involves setting clear, measurable objectives aligned with your financial goals. This plan should outline specific steps such as establishing an emergency fund, paying off high-interest debt, and contributing to retirement accounts. Prioritize these actions based on urgency and impact. Additionally, integrating accountability measures, like tracking progress through budgeting apps or financial advisors, keeps you motivated and on target.

In constructing your personal finance action plan, consider different timeframes for each goal. Short-term goals, such as saving for a vacation, can often be achieved within a year, while long-term aspirations like purchasing a home might take a decade or more. Prioritize tasks that have the most significant impact on your financial health. For instance, paying off high-interest credit card debt often yields the best returns. Encountering setbacks is normal; be sure to regularly assess your plan and amend it based on any new financial insights or life events. This adaptability ensures you remain proactive and prepared for whatever challenges come your way.

Conclusion

Considering all points, the journey to effective financial planning starts with the right tools that cater to your needs. By exploring budgeting apps, investment trackers, and savings calculators, you can empower yourself to make informed decisions about your finances. With consistent use of these tools, you can enhance your understanding of your financial situation, ultimately leading to greater confidence in achieving your financial goals. Begin utilizing these resources today, and take control of your financial future.

FAQ

Q: What are financial planning tools, and why are they important for beginners?

A: Financial planning tools are resources or applications designed to help individuals manage their finances effectively. For beginners, these tools can be invaluable as they provide insights into budgeting, savings, investment options, and debt management. They help lay the foundation for sound financial habits and allow users to track their progress over time.

Q: Which budgeting tools are recommended for someone just starting out?

A: For beginners, user-friendly budgeting tools such as Mint, YNAB (You Need A Budget), and EveryDollar are excellent options. Mint offers automatic bank account syncing and personalized insights, while YNAB focuses on proactive budgeting techniques to help users allocate every dollar. EveryDollar uses a simple zero-based budgeting approach that is straightforward for new users to grasp.

Q: How can I choose the right financial planning tool for my needs?

A: When deciding on a financial planning tool, consider your financial goals, comfort with technology, and preferred features. Some tools are better suited for budgeting, while others excel in investment tracking or debt management. It’s beneficial to read reviews, explore free trials, and evaluate which features align best with your personal finance objectives.

Q: Are there any free financial planning tools available for beginners?

A: Yes, there are many free financial planning tools available. Examples include Personal Capital for investment tracking, Google Sheets for customizable budgeting, and Mint for comprehensive financial management. These tools offer various functionalities without any cost, making them accessible to beginners looking to start their financial journey without financial barriers.

Q: How do I get started with using a financial planning tool?

A: To get started with a financial planning tool, follow these steps: first, choose a tool that aligns with your needs. Next, create an account and set up your profile by entering your financial information, such as income, expenses, and debts. Once your profile is established, explore the features available, and start tracking your finances. Frequent use and regular updates will enhance the effectiveness of the tool in achieving your financial goals.

Recent Comments