Most people want to achieve financial freedom, and building passive income is one of the best ways to get there. You can create income streams that require minimal effort after the initial investment by leveraging powerful tools and strategies. In this post, you’ll discover how to utilize these top resources to not only boost your earnings but also to secure your financial future with sustainable income sources. Let’s probe the important tools that can help you make your financial dreams a reality.

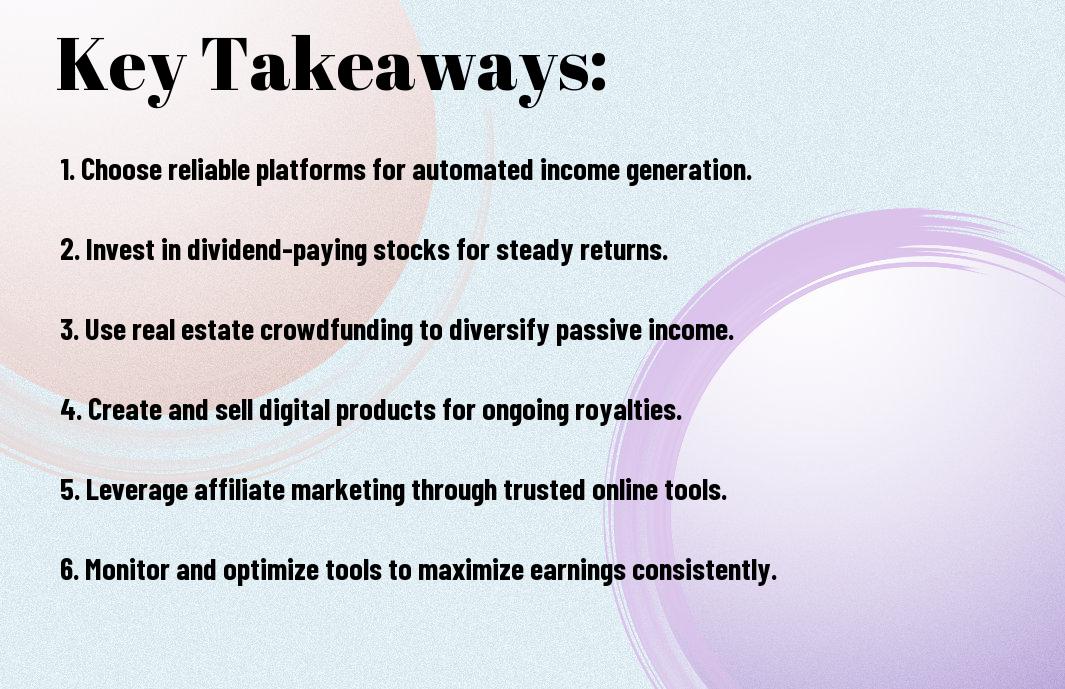

Key Takeaways:

- Identify the right tools that align with your skills and financial goals to streamline the passive income process.

- Consider various passive income streams such as real estate crowdfunding, dividend stocks, or affiliate marketing depending on your level of investment.

- Automate your processes wherever possible to reduce time spent managing your investments or income sources.

- Regularly assess and adjust your strategies based on performance metrics to ensure continued growth in income.

- Educate yourself continually on market trends and tool offerings to maximize profitability from your passive income sources.

The Power of Passive Income: Why It Matters

Passive income represents an opportunity to achieve financial independence, transforming your relationship with money. By leveraging your time and resources, you create income streams that can accumulate effortlessly, allowing you to focus on what truly matters in life. This approach helps mitigate financial stress and provides you with the freedom to explore personal passions or invest in further growth opportunities.

The Financial Freedom Equation

Achieving financial freedom hinges on balancing income against expenses. Passive income acts as a multiplying factor in this equation, enabling you to generate revenue without constant effort. By cultivating multiple streams of passive income, you create a buffer that cushions against economic uncertainties, ultimately allowing your wealth to grow organically.

Trends and Opportunities in 2023

The landscape of passive income in 2023 offers a wealth of opportunities, particularly in emerging technologies such as cryptocurrency, AI-based platforms, and decentralized finance (DeFi) applications. Many investors are exploring real estate crowdfunding models and online courses, increasingly relying on digital marketplaces to generate revenue. Communities like peer-to-peer lending sites provide avenues for securing passive returns with minimal risk.

With more people embracing remote work and entrepreneurship, the demand for digital products, like ebooks and online courses, is skyrocketing. Subscription-based services are also gaining traction, allowing creators to monetize their expertise effectively. In 2023, consider aligning your skill set with these trends for optimal passive income opportunities. The growing interest in sustainable investments opens doors for projects focused on eco-friendly initiatives as well. Don’t miss the chance to innovate and diversify your income streams in the current economic climate.

Essential Tools to Kickstart Your Passive Income Journey

Building a passive income stream requires leveraging the right tools to facilitate your journey. Whether it’s through investing, marketing, or creating content, utilizing specialized platforms can enhance your chances of success. Here’s a look at some of the important tools that can set you on the path to financial independence.

Real Estate Platforms: Exploring REITs and Crowdfunding

Real estate investment trusts (REITs) and crowdfunding platforms democratize access to property investment. With platforms like Fundrise and RealtyMogul, you can invest with as little as $500, gaining exposure to diversified real estate projects without managing properties directly. This can yield attractive returns, often better than traditional savings accounts.

Affiliate Marketing Networks: Connecting with Brands

Affiliate marketing networks make it easy for you to connect with brands that align with your content. Platforms like ClickBank and Amazon Associates provide a vast array of products to promote, allowing you to earn a commission with every sale made through your referral link.

By choosing the right affiliate marketing programs, you can enhance your earnings significantly. Many marketers leverage their blogs or social media to drive traffic to their affiliate links. With the right strategy, it’s possible to earn a passive income even while you sleep, as commissions are paid out automatically when someone makes a purchase through your link.

Dividend Investment Apps: Maximizing Stock Returns

Dividend investment apps such as Robinhood and M1 Finance enable you to build a portfolio that generates regular income through dividend payouts. By selecting dividend-paying stocks or ETFs, you enhance your cash flow while benefiting from potential stock appreciation.

These apps often provide user-friendly interfaces, making it simple to reinvest dividends automatically or withdraw them as passive income. By focusing on stocks with a history of increasing dividends, you can build a steady income stream that grows over time, enhancing your overall financial portfolio.

The Role of Digital Products in Creating Revenue Streams

Digital products serve as a versatile foundation for generating passive income, offering you both scalability and low overhead costs. Whether it’s e-books, online courses, or print-on-demand items, digital products enable you to reach a global audience without the complexities tied to physical goods. This accessibility helps you build multiple revenue streams, allowing your financial growth to multiply while you focus on content creation and marketing strategies.

Crafting E-Books and Online Courses: A Guide to Distribution

To effectively distribute your e-books and online courses, utilize platforms like Amazon Kindle Direct Publishing and Teachable. These marketplaces simplify the process, helping you reach a wide audience quickly. Implement strategies such as email marketing and social media promotions to drive traffic to your offerings, maximizing your sales potential while maintaining minimal active involvement.

Leveraging Marketplaces for Print-on-Demand Goods

Using print-on-demand services allows you to create custom merchandise without the need for inventory or upfront costs. Platforms such as Redbubble and Printful let you upload your designs, and they handle printing, shipping, and customer service. As a result, you can focus on creating eye-catching designs that align with your brand, tapping into fans and niches that will purchase your unique products. Furthermore, you can often set your own pricing, enhancing your profit margins as you gauge what transforms to successful sales.

Automating Income: The Tech Solutions You Need

Automation can streamline your income generation process, ensuring that your efforts work for you around the clock. Leveraging technology will not only save you time but also optimize your workflow, allowing you to focus on scaling your passive income streams effectively. Various tools and strategies can help automate your income, from managing your finances to marketing your digital products seamlessly.

Software Tools for Managing Investments

Using investment management software can help you track your portfolio effortlessly. Tools like Betterment and Wealthfront automate your investment strategy, allowing you to allocate funds based on your risk tolerance and financial goals. You can set up automated rebalancing and tax-loss harvesting features to ensure your investments remain aligned with your objectives, making it easier to grow your wealth over time.

Email Marketing Automation for Affiliate Success

Automating your email marketing is crucial for maximizing your affiliate earnings. With platforms like Mailchimp and ConvertKit, you can create effective automated campaigns that nurture leads and convert them into paying customers. Crafting personalized email sequences enables you to build relationships with your audience, increasing the likelihood they’ll purchase products through your affiliate links.

Email marketing automation not only saves you time but significantly enhances your reach. By segmenting your audience and delivering tailored content, you can effectively engage different groups based on their preferences. For instance, sending a welcome series upon signup can introduce subscribers to your best-performing affiliate products, while abandoned cart emails can gently remind prospects about items they expressed interest in. By automating these processes, you generate additional passive income with minimal active involvement, driving sales even while you sleep.

Evaluating Your Success: Metrics that Matter

Assessing your passive income success requires a keen understanding of relevant metrics. Track income growth, return on investment (ROI), and overall profitability. Use financial tools to analyze trends over time and maintain a balance between your ongoing efforts and returns. Focus on the metrics that align best with your specific income goals to ensure you’re on the right path. This way, you can identify what’s working, what needs adjusting, and how close you are to achieving your financial freedom.

Tracking Passive Income Growth Over Time

Monitoring the growth of your passive income is vital for understanding long-term viability. Keep detailed records of your income streams and assess performance monthly or quarterly. Calculate compound growth rates to visualize how your earnings increase over time, ensuring you adjust your strategies as necessary. This method illuminates patterns that can guide your future investments and inform your decision-making process.

Adjusting Strategies for Maximum Impact

To optimize your passive income, be proactive in adjusting your strategies based on the data you collect. If you notice stagnation in one area, consider reallocating resources or diversifying your investments. Analyze the performance of each income stream—such as rental properties or digital products—identifying the most lucrative avenues. Opportunities often present themselves through challenges; adapting your approach can lead to significant gains in revenue and stability over time.

For example, if one digital product isn’t generating as much interest as expected, researching market trends could unveil new opportunities for enhancement. Perhaps updating your marketing techniques or expanding to a new platform could reinvigorate sales. Setting a regular review schedule—perhaps quarterly—allows you to stay agile and responsive in shifting your focus where it’s needed. Making data-driven decisions will empower you to maximize your passive income potential effectively.

To wrap up

Summing up, building passive income can be a rewarding journey when you leverage the right tools. By utilizing online platforms, investing in stocks, or creating digital products, you can set yourself up for financial freedom. Make informed decisions based on your interests and goals, and continuously educate yourself about emerging opportunities. With commitment and the right strategies, you can create a sustainable stream of income that enhances your financial stability.

FAQ

Q: What are passive income streams?

A: Passive income streams are earnings that require minimal effort to maintain after the initial setup. These can include income from investments, rental properties, royalties from creative works, or profits from automated online businesses. The idea is to create a source of income that continues to generate revenue without the need for continuous active work.

Q: Which tools are effective for building passive income?

A: There are several tools available that can help in building passive income. Some popular options include affiliate marketing platforms (like Amazon Associates), stock photography websites (such as Shutterstock), print-on-demand services (like Teespring), investment apps (like Robinhood or Betterment), and online course platforms (such as Udemy or Teachable). Each tool has its own unique benefits depending on your personal interests and expertise.

Q: How can I automate my income generation processes?

A: To automate income generation, consider utilizing marketing automation tools, social media schedulers, or email marketing platforms. Tools like Hootsuite for social media or Mailchimp for email campaigns allow you to set up automated workflows, freeing you from constant engagement while still reaching your audience. Additionally, using e-commerce platforms that handle payment processing and order fulfillment can also create a hands-off income stream.

Q: Is it possible to create passive income with little to no money?

A: Yes, it is feasible to build passive income with minimal financial investment. Many methods depend more on time and creativity rather than capital. For example, starting a blog or YouTube channel can be free or low-cost and, over time, can generate income through ads and sponsorships. Writing an eBook or developing an online course also requires little upfront investment if you leverage existing knowledge or skills.

Q: How long does it take to start seeing results from passive income strategies?

A: The time it takes to see results from passive income strategies varies greatly depending on the method chosen, effort put in, and market conditions. Some people may start earning in a few months, while others might take years to build substantial income streams. Consistency in creating high-quality content or effectively marketing your products is key to speeding up the process.

Recent Comments